Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Australian CPI Data Overview

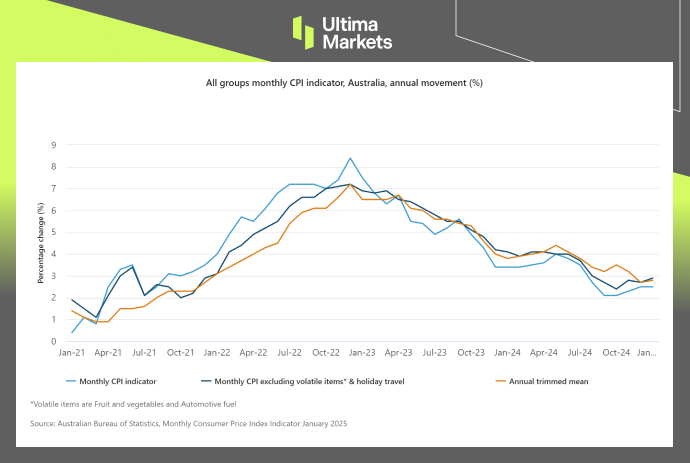

The latest Australian Monthly CPI data released today showed a 2.5% year-on-year increase in January 2025, unchanged from the previous month and slightly below market expectations of 2.6%. This keeps Australia’s inflation rate at a four-month high.

Excluding volatile items such as food and energy, core CPI rose by 2.9%, marking the highest level in five months following a 2.7% increase in December. Meanwhile, the trimmed mean CPI, an alternative measure of underlying inflation that smooths out irregular or temporary price fluctuations, came in at 2.8% in January, up from 2.7% in December.

(Australia Monthly CPI Chart; Source: Australia Bureau of Statistics)

RBA Outlook: What’s Next?

While the latest CPI data does not provide a strong case for increasing bets on RBA rate cuts, the steady inflation—without significant acceleration or slowdown—reinforces the Reserve Bank of Australia’s (RBA) cautious stance from its February meeting.

The CPI figures largely align with the RBA’s inflation forecast trajectory, suggesting that the central bank will likely remain on hold, carefully assessing upcoming data and external risks before making further policy adjustments.

During its February meeting, the RBA stated that:

- “Do not expect further rate cuts” after delivering its first cut

- Emphasizing the need to evaluate further economic data before taking action.

The market currently anticipates that the RBA’s second rate cut will only come in mid-2025, likely after the Q1 2025 inflation data release on April 30.

Technical Outlook on AUDUSD

The Aussie dollar saw little reaction to the CPI release, as minimal inflation changes failed to drive major moves. In the near term, AUD remains driven by USD strength and market sentiment.

Uncertainty over Trump’s trade policies has weighed on risk-sensitive currencies like the AUD, NZD, and CAD, limiting upside potential.

(AUD/USD, H4: Chart Analysis; Source: Trading View)

Technically, AUD/USD remains in an uptrend after breaking above 0.6320. As long as this support holds, the pair may continue its bullish trajectory, supported by a weaker USD.

A break below 0.6320 or a US Dollar rebound could shift momentum, but otherwise, AUD/USD may target 0.6400 in the near term.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행