Canada Inflation Rate Softens, BoC Likely to Hold

TOPICSCanada’s annual inflation rate unexpectedly eased to 2.3% in March 2025, down from 2.6% in February—an eight-month high—and below market expectations of 2.5%. Core inflation also slowed to 2.2%, indicating a broader cooling in underlying price pressures.

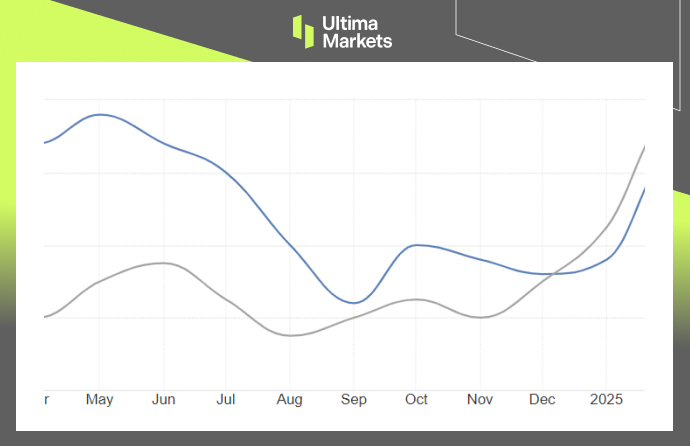

(Canada Inflation & Core Inflation Rate; Source: Trading Economics)

The moderation in inflation aligns with the Bank of Canada’s (BoC) expectations of normalization, following the temporary spike caused by the goods and services tax (GST) changes earlier this year.

BoC April Meeting: Dovish Pause is Likely

The softer inflation data has fueled speculation about another rate cut from the Bank of Canada (BoC), although markets largely expect the central bank to keep rates unchanged at today’s policy meeting.

Over the past 10 months, the BoC has already reduced its benchmark rate by a total of 225 basis points, bringing the policy rate to 2.75%, the midpoint of its estimated neutral range.

In its previous meeting, the BoC adopted a cautious approach toward future monetary policy changes, noting that “monetary policy cannot offset the impacts of a trade war.” However, the central bank refrained from offering explicit forward guidance due to the high uncertainty surrounding the economic effects of the ongoing trade conflict.

This caution suggests a “wait-and-see” stance, with a rate pause expected in today’s decision. Nevertheless, the recent inflation figures indicate that the door remains open for further rate cuts later in 2025.

Today’s BoC rate decision will be accompanied by the release of the quarterly Monetary Policy Report and a press conference by Governor Tiff Macklem. While a pause is anticipated, the BoC is likely to adopt a dovish tone, keeping the possibility of further easing on the table, especially given the growing uncertainty over U.S. trade policy under President Trump.

Canadian Dollar Weakens After Inflation Data

The Canadian Dollar weakened against major currencies following the release of the CPI data, as markets kept bets on further rate cuts alive. Despite a weaker U.S. Dollar, the CAD traded lower on Tuesday after the CPI report.

(USDCAD, Day Chart Analysis; Source: Ultima Markets MT5)

From a technical perspective, despite the rebound in USDCAD, the Canadian Dollar could still strengthen against the U.S. Dollar if the currency’s weakness persists. Struggling below the 1.3960 resistance level, USDCAD may see further downside if the CAD gains momentum following the BoC meeting.

(CADJPY, 4-H Chart Analysis; Source: Ultima Markets MT5)

Meanwhile, the Canadian Dollar could weaken further against the Japanese Yen if the BoC signals a more dovish policy path amid ongoing uncertainty. At the same time, the Yen may continue to strengthen as a safe-haven currency.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server