Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

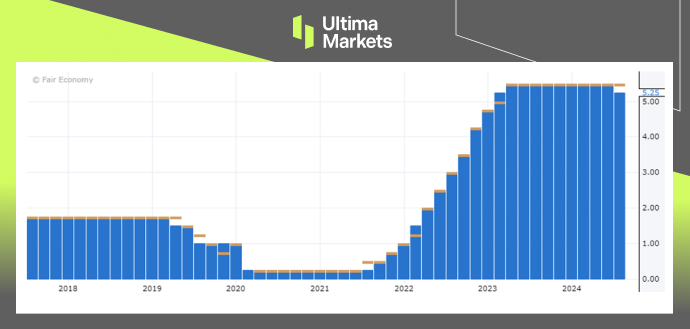

The Reserve Bank of New Zealand (RBNZ) has surprised markets by cutting its benchmark rate by 25 basis points to 5.25%, the first reduction since March 2020. This unexpected move, which indicates a pronounced dovish stance, comes as inflation approaches the 1% to 3% target range.

(RBNZ’s Official Cash Rate)

Previously, rate cuts were not anticipated by the RBNZ until mid-2025. However, New Zealand now aligns with a global trend towards monetary easing, joining other central banks that have also implemented interest rate reductions. The early rate cut which is ahead of the RBNZ’s prior forecasts has led to a decline in the kiwi. NZD/USD pair dipped 1.34%, closed at 0.59960.

(NZD/USD Daily Price Chart)

The central bank tempered its announcement with caution, underscoring that policy will need to stay restrictive for an extended period. Nonetheless, it projected that the cash rate would decline to 3.85% by the end of 2025. Market expectations for additional cuts mirrored the central bank’s gloomy economic forecasts.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Neden Ultima Markets ile Metaller ve Emtia Ticareti Yapmalısınız?

Ultima Markets, dünya çapında yaygın emtialar için en rekabetçi maliyet ve değişim ortamını sağlar.

Ticarete BaşlaHareket halindeyken piyasayı izleme imkanı

Piyasalar arz ve talepteki değişimlere duyarlıdır

Sadece fiyat spekülasyonu ile ilgilenen yatırımcılar için çekici

Derin ve çeşitli likidite ile gizli ücretler yok

Dealing desk yok ve yeniden fiyatlandırma yok

Equinix NY4 sunucusu üzerinden hızlı yürütme